Gold Prices

Why Are Gold Bar Sales Surging at Costco?

Costco has become a hotspot for purchasing gold bars, with sales reportedly reaching up to $200 million monthly. This surge in gold sales at the warehouse retailer has caught the attention of both consumers and market analysts, prompting a closer look at the reasons behind this phenomenon and its implications for the market and Costco's strategy.

The Surge in Sales

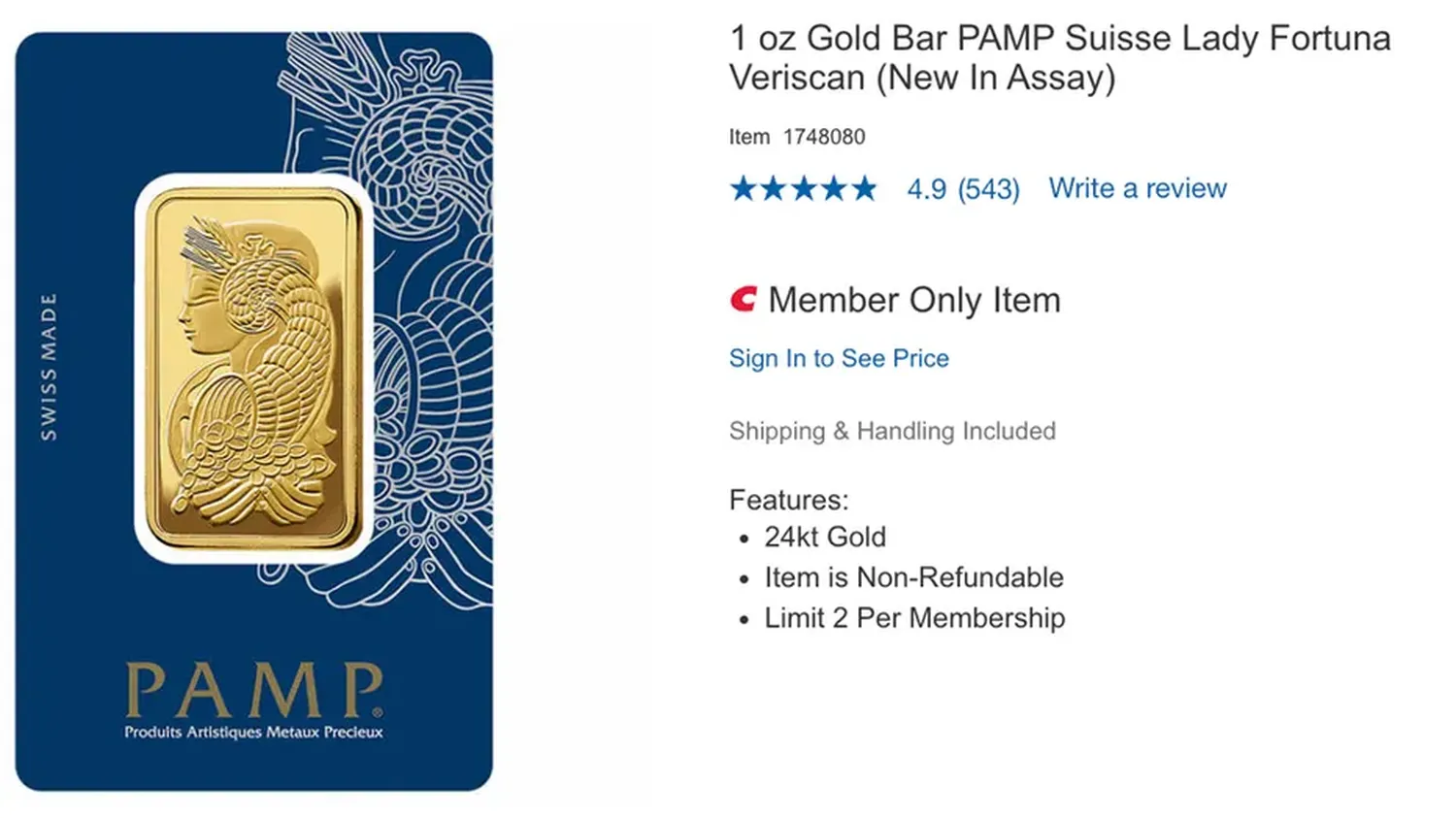

Costco introduced one-ounce, 24-karat gold bars to its product lineup in October, with the items quickly becoming a sought-after commodity among its members. According to Wells Fargo, the retailer is now selling between $100 million and $200 million worth of gold and silver each month. This significant sales volume has been driven by a combination of economic uncertainty, inflation concerns, and the allure of gold as a traditional safe-haven asset.

The timing of Costco's entry into the gold market coincides with a period of heightened economic anxiety. Inflation rates have remained stubbornly high, despite improvements in the U.S. economic outlook and a slowdown in inflation. Additionally, geopolitical tensions, such as the ongoing situation in Ukraine, have further fueled interest in gold as a stable investment option.

Impact on the Market

While Costco's gold sales have undoubtedly been successful, the impact on the broader gold market is nuanced. The retailer's competitive pricing and the trust it enjoys among its customer base have made it an attractive venue for purchasing gold. However, experts warn that the rush to buy gold bars from Costco may be more indicative of a "mob mentality" rather than sound investment decision-making. Financial advisors caution that investing in physical gold bars requires a clear understanding of one's investment goals and the risks involved, including potential taxes on collectibles and the challenges of selling physical gold.

Customer Demographics

An interesting aspect of Costco's gold sales is the demographic appeal. While there have been anecdotal reports of millennials showing interest in purchasing gold bars from Costco, broader demographic trends are difficult to ascertain. Gold has traditionally been viewed as a conservative investment, appealing to those looking to hedge against economic instability. Costco's ability to attract a diverse customer base to its gold offerings speaks to the retailer's wide appeal and the universal allure of gold as an investment.

Costco's Strategy

Costco's foray into gold sales aligns with its broader strategy of offering unique, high-value items to its members. The retailer is known for its limited selection of high-quality goods at competitive prices, and gold bars are no exception. By selling gold bars at approximately 2% above the spot price, Costco reinforces its value proposition to members. However, analysts suggest that the profit margins on these sales are likely minimal, given the pricing and shipping costs involved.

Despite the low-profit nature of the business, the gold sales initiative has generated significant buzz and media attention for Costco. This has not only bolstered the retailer's image as a one-stop-shop for a wide range of products but also attracted new customers interested in investing in gold.

In conclusion, Costco's gold bar sales surge is a multifaceted phenomenon driven by economic uncertainty, the retailer's competitive pricing, and its strong brand trust among consumers. While the long-term impact on the gold market and Costco's bottom line remains to be seen, this initiative has undoubtedly added a new dimension to the retailer's diverse product offerings. As the economic landscape continues to evolve, Costco's gold bars may remain an attractive option for those looking to diversify their investment portfolios with a time-tested asset.